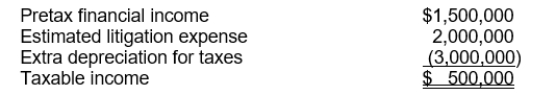

Use the following information for questions 58 through 60.

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

-Income taxes payable is

Definitions:

Common Name

A name by which a species is known to the general public, as opposed to its scientific or Latin name.

Trademark Infringement

An unauthorized use of a trademark or service mark on competing or related goods and services, leading to a likelihood of confusion.

Injunction

An order issued by a court that compels a person or entity to either take a certain action or stop doing something.

Damages

Monetary compensation awarded by a court to a person who suffers loss or harm due to another's act or omission.

Q16: Midland Company follows U.S. GAAP for its

Q19: Deferred tax amounts that are related to

Q26: Colt Corporation purchased Massey Inc. and agreed

Q28: At December 31, 2014, Hancock Company had

Q35: Investments in debt securities should be recorded

Q49: Warrants exercisable at $20 each to obtain

Q51: The Accumulated Other Comprehensive Income (G/L) account

Q68: If Alt accounts for the lease as

Q89: A pension plan is contributory when the

Q120: In a defined-benefit plan, the process of