Multiple Choice

Use the following information for questions 86 and 87.

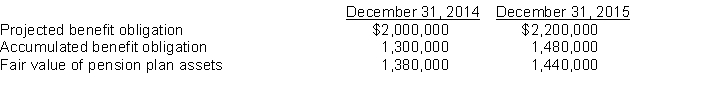

Foster Corporation received the following report from its actuary at the end of the year:

-The amount reported as the pension liability at December 31, 2015 is

Definitions:

Related Questions

Q1: Accrued salaries payable of $51,000 were not

Q36: Stuart Corporation's taxable income differed from its

Q37: Which of the following statements about the

Q72: In a contingent issue agreement, the contingent

Q87: In selecting an accounting method for a

Q102: Fill in the dollar changes caused in

Q106: Assuming the income taxes payable at the

Q113: Midland Company follows U.S. GAAP for its

Q134: In preparing Titan Inc.'s statement of

Q136: For the year ended December 31, 2015,