Use the following information for questions 73 and 74.

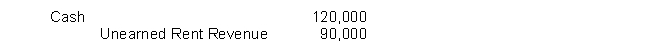

Kraft Company made the following journal entry in late 2014 for rent on property it leases to Danford Corporation.  The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

-Assuming the income taxes payable at the end of 2015 is $204,000, what amount of income tax expense would Kraft Company record for 2015?

Definitions:

Extreme Values

Observations that are significantly higher or lower than the majority of data points in a dataset.

Distribution of Weights

The spread of different weights within a dataset, showing how often each weight occurs.

Quartiles

Values that divide a data set into four equal parts, representing the distribution of the data from the lowest to the highest values.

Weights of Police Officers

Refers to the body mass of police officers, which can be a factor in physical fitness assessments or health evaluations.

Q30: In computing the annual lease payments, the

Q47: Myers Company acquired a 60% interest in

Q64: If the lease were nonrenewable, there was

Q65: During 2015, a construction company changed from

Q66: On January 1, 2015 Dairy Treats, Inc.

Q79: One of the disclosure requirements for a

Q94: What accounting treatment is required for convertible

Q102: Under IFRS, companies are not required to

Q112: A lessor with a sales-type lease involving

Q128: If Rushia Company determines that the fair