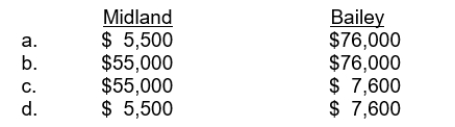

Midland Company follows U.S. GAAP for its external financial reporting whereas Bailey Company follows IFRS for its external financial reporting. The amount contributed by Midland for its defined contribution plan for 2015 amounted to $55,000 and the amount contributed by Bailey for its defined contribution plan for 2015 amounted to $76,000. The remaining service lives of employees at both firms is estimated to be 10 years. What is the amount of expense related to pension costs recognized by each company in its income statement for the year ended December 31, 2015?

Definitions:

Helmholtz

Refers to Hermann von Helmholtz, a 19th-century German scientist known for his contributions to the study of vision, hearing, and the conservation of energy.

Place Theory

A theory in hearing that proposes different areas of the cochlea are activated by different frequencies of sounds, contributing to the perception of pitch.

Oval Window

A membrane-covered opening that leads from the middle ear to the vestibule of the inner ear and is involved in the process of hearing.

Tympanic Membrane

A thin membrane that separates the outer ear from the middle ear and vibrates in response to sound waves, also known as the eardrum.

Q10: In a lease that is appropriately recorded

Q20: Judd, Inc., owns 35% of Cosby Corporation.

Q31: Before the correction was made, and before

Q56: The deferred tax asset to be recognized

Q58: Classification of cash flows and transactions.Give:(a) Three

Q61: The net cash provided (used) by investing

Q69: Horner Construction Co. uses the percentage-of-completion method.

Q84: Under IFRS, the direct effects of changes

Q87: The balance of the projected benefit obligation

Q102: Under IFRS, companies are not required to