Use the following information for questions 55 through 57.

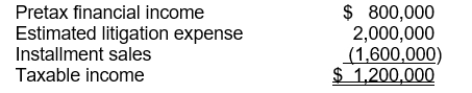

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

-The deferred tax asset to be recognized is

Definitions:

Different Ratios

Proportions or comparative quantities of elements or components in a mixture or compound.

Compound

A substance made up of two or more different elements chemically combined in fixed proportions.

Elements

Pure chemical substances consisting of a single type of atom, distinguished by their atomic number, which is the number of protons in their atomic nuclei.

Gold Foil Experiment

An experiment conducted by Ernest Rutherford which demonstrated that the atom has a tiny, dense nucleus by observing the deflection of alpha particles.

Q45: In the "On the Horizon" feature in

Q46: The deferred tax liability-current to be recognized

Q46: Which of the following lease-related revenue and

Q69: Pretax financial income is the amount used

Q73: Prior service cost is recognized on the

Q79: Equity security holdings between 20 and 50

Q86: Explain the procedures used by the lessee

Q88: If a company transfers held-to-maturity securities to

Q100: The interest component of pension expense in

Q134: A requirement for a security to be