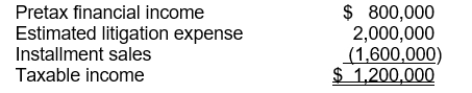

Use the following information for questions 55 through 57.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

-The deferred tax liability-current to be recognized is

Definitions:

Premium

An amount paid regularly to insure something or to cover the cost of a policy, also used to describe the amount paid over the nominal value of something.

Bonds

Long-term debt securities issued by corporations and government entities that pay interest to the holder.

Contract Rate

A pre-agreed interest rate applied in the calculation of payments for a specific financial contract.

Market Rate

The prevailing interest rate available in the marketplace for instruments of comparable risk and maturity.

Q11: A capitalized leased asset is always depreciated

Q21: Under the operating method, the lessor records

Q33: The income tax expense is<br>A) $240,000.<br>B) $360,000.<br>C)

Q49: Based solely upon the following sets of

Q56: A lessee had a ten-year capital lease

Q58: On December 1, 2015, Goetz Corporation

Q91: Stone Company changed its method of pricing

Q101: On January 1, 2012, Lake Co. purchased

Q114: In computing diluted earnings per share, stock

Q136: If an employee forfeits a stock option