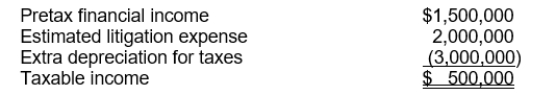

Use the following information for questions 58 through 60.

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

-Income taxes payable is

Definitions:

Probability

A measure of the likelihood that an event will occur, quantified as a number between 0 and 1.

Charity Raffle

A fundraising event where tickets are sold for the opportunity to win prizes, with the proceeds going to support a charitable cause.

Clinical Trials

Research studies conducted with human volunteers designed to evaluate the safety and efficacy of new treatments or interventions.

FDA Approval

FDA approval is the authorization granted by the U.S. Food and Drug Administration for a drug or medical device to be marketed or sold after it has been proven safe and effective for use.

Q6: Dobson Construction specializes in the construction of

Q17: Nagel Co.'s prepaid insurance was $95,000 at

Q18: Ignoring income taxes, the amount of expense

Q33: The estimated life of a building that

Q42: Hayes Corp. is a manufacturer of truck

Q68: Surf Company follows IFRS for its

Q91: On July 4, 2014, Chen Company issued

Q113: All of the following statements regarding accounting

Q122: Presented below is pension information related

Q151: What effect will the acquisition of treasury