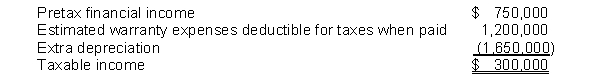

at the end of 2015, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  Estimated warranty expense of $800,000 will be deductible in 2016, $300,000 in 2017, and $100,000 in 2018. The use of the depreciable assets will result in taxable amounts of $550,000 in each of the next three years.

Estimated warranty expense of $800,000 will be deductible in 2016, $300,000 in 2017, and $100,000 in 2018. The use of the depreciable assets will result in taxable amounts of $550,000 in each of the next three years.

Instructions

(a) Prepare a table of future taxable and deductible amounts.

(b) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2015, assuming an income tax rate of 40% for all years.

Definitions:

More Laws

Refers to the increase in legislation or regulations within a society, intended to address issues, regulate behavior, or govern certain activities.

CEOs

Chief Executive Officers (CEOs) are the highest-ranking executives in a company or organization, responsible for making major corporate decisions, managing the overall operations and resources, and acting as the main point of communication between the board of directors and corporate operations.

Alienation

Marxist concept to describe the process by which workers lack connection to what they produce and become separated from themselves and other workers.

Exploitation

The act of using someone or something unfairly for one's own advantage, often in a context of power imbalance and to the detriment of the exploited party.

Q25: Ziegler Corporation purchased 25,000 shares of common

Q39: Assuming a 30% tax rate, the cumulative

Q61: Lehman Corporation purchased a machine on January

Q61: A "secret reserve" will be created if<br>A)

Q65: Participating preferred stock requires that if a

Q75: Khan, Inc. reports a taxable and financial

Q84: Under IFRS, the direct effects of changes

Q89: How much investment income should Dexter report

Q93: In computing depreciation of a leased asset,

Q96: On May 1, 2014, Payne should credit