Use the following information for questions 73 and 74.

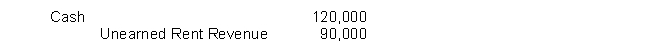

Kraft Company made the following journal entry in late 2014 for rent on property it leases to Danford Corporation.  The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

-What amount of income tax expense should Kraft Company report at the end of 2014?

Definitions:

Contribution Format

A way of presenting an income statement where variable and fixed costs are shown separately, highlighting the contribution margin.

Segmented Income Statement

An income statement that divides data by segment, department, or product line to analyze each segment's financial performance.

Contribution Format

A form of income statement where costs are divided into variable and fixed categories, highlighting the contribution margin of products.

Common Fixed Expenses

Expenses that do not change with the level of production or sales and are shared by multiple products or departments within a company.

Q1: Debt securities acquired by a corporation which

Q11: Companies should classify the balances in the

Q17: Nagel Co.'s prepaid insurance was $95,000 at

Q33: Melton Company sold some machinery to Addison

Q37: Presenting consolidated financial statements this year when

Q37: Pasta Inn charges an initial fee of

Q38: On January 1, 2014, Trent Company granted

Q71: If Yates records this lease as a

Q88: Continuing franchise fees should be recorded by

Q122: Newton Co. had installment sales of $1,000,000