The following information is available for Kessler Company after its first year of operations:  Kessler estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was $85,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?

Kessler estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was $85,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?

Definitions:

Immediate Instructions

Immediate instructions are commands executed directly and instantly within a control program, often affecting control logic or operations without delay.

Q3: Uncertain tax positions<br>I.Are positions for which the

Q18: Ignoring income taxes, the amount of expense

Q38: Lanier Company began operations on January 1,

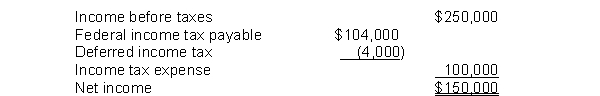

Q62: Didde Corp. prepared the following reconciliation of

Q85: Dexter purchases equipment from Ray Company for

Q94: Braun, Inc. appropriately uses the installment-sales method

Q102: Fill in the dollar changes caused in

Q110: Nondetachable warrants, as with detachable warrants, require

Q133: The fair value option allows a company

Q143: Monroe Construction Company uses the percentage-of-completion method