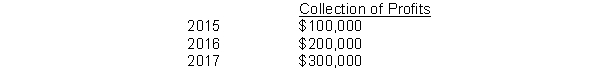

Duncan Inc. uses the accrual method of accounting for financial reporting purposes and appropriately uses the installment method of accounting for income tax purposes. Profits of $600,000 recognized for books in 2014 will be collected in the following years:  The enacted tax rates are: 40% for 2014, 35% for 2015, and 30% for 2016 and 2017. Taxable income is expected in all future years. What amount should be included in the December 31, 2014, balance sheet for the deferred tax liability related to the above temporary difference?

The enacted tax rates are: 40% for 2014, 35% for 2015, and 30% for 2016 and 2017. Taxable income is expected in all future years. What amount should be included in the December 31, 2014, balance sheet for the deferred tax liability related to the above temporary difference?

Definitions:

Ability Traits

Traits that describe our skills and how efficiently we will be able to work toward our goals.

Factor Analysis

A statistical technique that explains the variance among observed, correlated variables by a smaller set of unobserved variables, known as factors.

Structural Units

Fundamental components or building blocks that make up a system, organization, or structure.

Factor Analysis

A statistical method used to identify underlying variables, or factors, that explain the pattern of correlations within a set of observed variables.

Q8: Equity securities acquired by a corporation which

Q13: Haag Corp.'s 2015 income statement showed pretax

Q23: at the end of 2015, its

Q35: Lessors classify and account for all leases

Q35: In applying the treasury stock method to

Q45: In computing the service cost component of

Q57: Retrospective application refers to the application of

Q72: The amount reported as the pension liability

Q76: At December 31, 2014 Raymond Corporation reported

Q136: If an employee forfeits a stock option