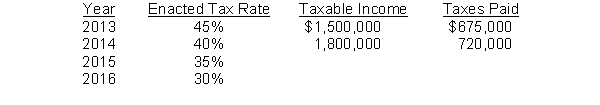

Nickerson Corporation began operations in 2013. There have been no permanent or temporary differences to account for since the inception of the business. The following data are available:  In 2015, Nickerson had an operating loss of $1,860,000. What amount of income tax benefits should be reported on the 2015 income statement due to this loss assuming that it uses the carryback provision?

In 2015, Nickerson had an operating loss of $1,860,000. What amount of income tax benefits should be reported on the 2015 income statement due to this loss assuming that it uses the carryback provision?

Definitions:

Required Rate Of Return

The minimal annual profit rate required to attract investment from individuals or corporations into a specific security or initiative.

Net Present Value

A financial analysis technique used to estimate the viability of projects or investments by discounting expected future cash flows to their present value.

Payback Period

The duration of time it takes to recoup the initial investment in a project or asset.

Cash Inflows

Cash Inflows are the money or cash received by a business from its various activities, including sales, investments, financing, etc.

Q4: Assume that the 2014 errors were not

Q21: Which of the following temporary differences results

Q70: What was the initial estimated total income

Q70: What should be the gain on sale

Q72: The installment-sales method defers only the gross

Q78: Corporations issue convertible debt for two main

Q121: Match the approach and location where gains

Q121: At December 31, 2015, Eilert would report

Q122: If a decline in a security's value

Q127: During 2014, Woods Company purchased 60,000 shares