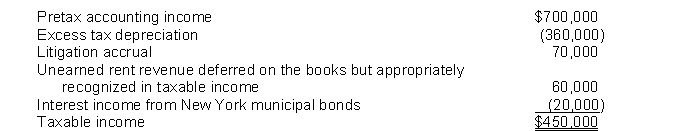

The following differences enter into the reconciliation of financial income and taxable income of Abbott Company for the year ended December 31, 2014, its first year of operations. The enacted income tax rate is 30% for all years.  1. Excess tax depreciation will reverse equally over a four-year period, 2015-2018.2. It is estimated that the litigation liability will be paid in 2018.3. Rent revenue will be recognized during the last year of the lease, 2018."4. Interest revenue from the New York bonds is expected to be $20,000 each year until their maturity at the end of 2018.

1. Excess tax depreciation will reverse equally over a four-year period, 2015-2018.2. It is estimated that the litigation liability will be paid in 2018.3. Rent revenue will be recognized during the last year of the lease, 2018."4. Interest revenue from the New York bonds is expected to be $20,000 each year until their maturity at the end of 2018.

Instructions

(a) Prepare a schedule of future taxable and (deductible) amounts.

(b) Prepare a schedule of the deferred tax (asset) and liability at the end of 2014.

(c) Since this is the first year of operations, there is no beginning deferred tax asset or liability. Compute the net deferred tax expense (benefit).(d) Prepare the journal entry to record income tax expense, deferred taxes, and the income taxes payable for 2014."

Definitions:

Chart

A visual representation of data designed to make information easier to understand, can be in various forms like pie, line, or bar.

Quick Table

A predefined table template feature in some word processing software that allows users to insert a table quickly by selecting from a variety of common table layouts and designs.

Preformatted Table Template

A predefined layout provided by software programs for creating tables with specific formatting automatically applied.

Document

A written, drawn, presented, or memorialized representation of thoughts, often in a digital format such as Word, PDF, etc.

Q15: Which of the following would not be

Q36: Which of the following is an advantage

Q45: At December 31, 2014, the fair value

Q46: Barton, Inc. received the following information from

Q50: A seller is using the cost-recovery method

Q55: Computation of taxable income.The records for

Q65: What amount would be reported as accumulated

Q107: Rossi Company has a defined-benefit plan.

Q120: A company reduces a deferred tax asset

Q142: In consignment sales, the consignee<br>A) records the