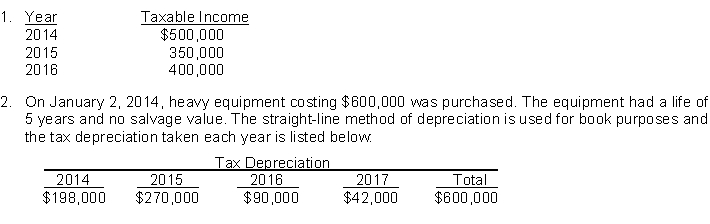

The following information is available for the first three years of operations for Cooper Company:  3. On January 2, 2015, $300,000 was collected in advance for rental of a building for a three-year period. The entire $300,000 was reported as taxable income in 2015, but $200,000 of the $300,000 was reported as unearned revenue at December 31, 2015 for book purposes."4. The enacted tax rates are 40% for all years.

3. On January 2, 2015, $300,000 was collected in advance for rental of a building for a three-year period. The entire $300,000 was reported as taxable income in 2015, but $200,000 of the $300,000 was reported as unearned revenue at December 31, 2015 for book purposes."4. The enacted tax rates are 40% for all years.

Instructions

(a) Prepare a schedule comparing depreciation for financial reporting and tax purposes.

(b) Determine the deferred tax (asset) or liability at the end of 2014.

(c) Prepare a schedule of future taxable and (deductible) amounts at the end of 2015.(d) Prepare a schedule of the deferred tax (asset) and liability at the end of 2015.(e) Compute the net deferred tax expense (benefit) for 2015.(f) Prepare the journal entry to record income tax expense, deferred income taxes, and income tax payable for 2015."

Definitions:

Emotional Intelligence

The capability to recognize, understand, manage, and utilize one's own emotions and those of others in positive ways to relieve stress, communicate effectively, empathize with others, overcome challenges and defuse conflict.

Street Smarts

Practical knowledge and experience on how to handle personal and situational challenges in urban environments.

G Factor

A general intelligence factor believed to underlie specific mental abilities and talents across individuals.

Emotional Intelligence

The skill to comprehend, utilize, and control one's emotions constructively to mitigate stress, communicate successfully, connect empathetically with others, and conquer obstacles.

Q3: Which of the following will be included

Q12: In 2012, Concord Inc. sells inventory with

Q65: For stock appreciation rights, the measurement date

Q86: On February 1, 2014, Marsh Contractors agreed

Q87: On its December 31, 2014, balance sheet,

Q90: On December 31, 2014, Patel Company purchased

Q91: An option to convert a convertible bond

Q98: A deferred tax asset represents the increase

Q109: Rathke, Inc. has a defined-benefit pension plan

Q122: Hartman, Inc. has prepared the following