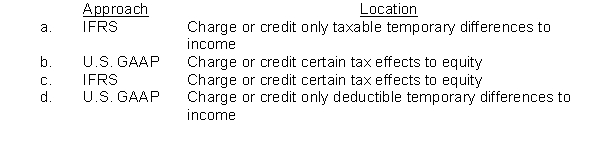

Match the approach, IFRS or U.S. GAAP, with the location where tax effects are reported:

Definitions:

Amortization

The process of gradually writing off the initial cost of an intangible asset over its useful life.

Goodwill

Represents the excess of the purchase price over the fair value of identifiable net assets acquired in a business combination. It reflects intangible assets like brand reputation and customer relationships.

Inventoriable Costs

Costs associated with obtaining or manufacturing products intended for sale, which become part of a company’s inventory.

Computer Software

Refers to programs and other operating information used by a computer to perform specific tasks.

Q1: Seigel Co. maintains a defined-benefit pension plan

Q4: On January 1, 2015, McGee Co.

Q10: Income taxes payable is<br>A) $0.<br>B) $150,000.<br>C) $300,000.<br>D)

Q39: Milo Co. had 700,000 shares of common

Q53: Whenever a defined-benefit plan is amended and

Q68: Surf Company follows IFRS for its

Q72: Changes in the fair value of a

Q72: In a contingent issue agreement, the contingent

Q104: With respect to this capitalized lease, for

Q143: On January 2, 2014, Farr Co. issued