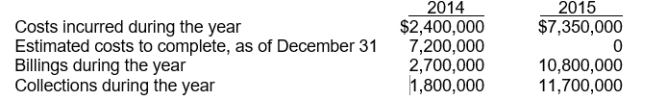

Use the following information for questions 76 and 77.

Gomez, Inc. began work in 2014 on contract #3814, which provided for a contract price of $14,400,000. Other details follow:

-Assume that Gomez uses the completed-contract method of accounting. The portion of the total gross profit to be recognized as income in 2015 is

Definitions:

Landlord

The owner of a property who leases it to a tenant under a rental agreement, responsible for maintaining the property and adhering to the lease terms.

Tenants

Tenants are individuals who occupy land or property rented from a landlord.

Common Areas

Spaces within a building or property that are available for use by all occupants or members, such as lobbies, corridors, and recreational facilities.

Tort Law

A branch of civil law that deals with situations where a person's behavior has unlawfully caused harm or suffering to another person, resulting in legal liability.

Q20: Younger Company has outstanding both common stock

Q35: Lessors classify and account for all leases

Q40: IFRS requires that changes in estimate be

Q50: When a corporation issues its capital stock

Q59: Companies must periodically review the estimated unguaranteed

Q70: The following facts relate to the

Q96: In 2014, its first year of operations,

Q106: A sale should not be recognized as

Q123: Hiser Builders, Inc. is using the

Q148: According to the FASB, redeemable preferred stock