had $700,000 net income in 2015. On January 1, 2015 there were 200,000 shares of common stock outstanding. On April 1, 20,000 shares were issued and on September 1, Colson bought 30,000 shares of treasury stock. There are 30,000 options to buy common stock at $40 a share outstanding. The market price of the common stock averaged $50 during 2015. The tax rate is 40%.During 2015, there were 40,000 shares of convertible preferred stock outstanding. The preferred is $100 par, pays $3.50 a year dividend, and is convertible into three shares of common stock.Colson issued $2,000,000 of 8% convertible bonds at face value during 2014. Each $1,000 bond is convertible into 30 shares of common stock.

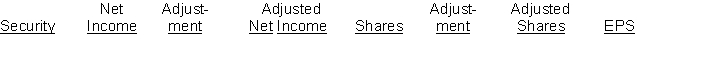

InstructionsCompute diluted earnings per share for 2015. Complete the schedule and show all computations.

Definitions:

Option Clearing Corporation

The organization responsible for ensuring the proper settlement of options contracts and mitigating counterparty risk in the options market.

Post Margin

The amount of collateral a participant must deposit with a clearinghouse to cover potential future losses on positions.

Purchased

The act of acquiring ownership of an asset in exchange for payment.

Digital Option

A type of option that pays either a fixed amount of cash or nothing at all, depending on whether a certain condition is met at expiration.

Q15: Which of the following taxes does not

Q27: Which of the following items is a

Q33: Yoder, Inc. has 150,000 shares of $10

Q50: A seller is using the cost-recovery method

Q57: Wheeler Company issued 5,000 shares of its

Q75: On January 1, 2015, Piper Co. issued

Q76: At December 31, 2014 Raymond Corporation reported

Q92: Jerome Co. has the following deferred tax

Q127: Valley, Inc., is a retail store operating

Q168: Bargain Surplus made cash sales during the