On April 7, 2014, Kegin Corporation sold a $4,000,000, twenty-year, 8 percent bond issue for $4,240,000. Each $1,000 bond has two detachable warrants, each of which permits the purchase of one share of the corporation's common stock for $30. The stock has a par value of $25 per share. Immediately after the sale of the bonds, the corporation's securities had the following market values:  What accounts should Kegin credit to record the sale of the bonds?

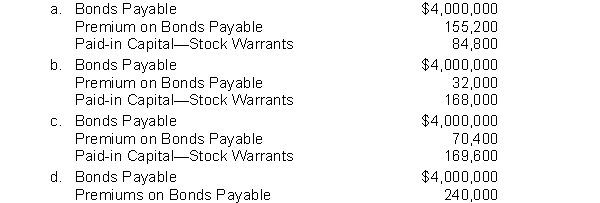

What accounts should Kegin credit to record the sale of the bonds?

Definitions:

Purchase Price

The total cost that is paid to acquire an asset or service, often including additional fees and taxes beyond the sticker price.

Equity Method

An accounting technique used to record investments where the investor has significant influence but does not control the investee.

Net Income

The remaining earnings of a company after subtracting total expenses and taxes from its gross revenue.

Dividends

Payments made by a corporation to its shareholders, usually out of profits or reserves.

Q12: Lump sum issuance of stock.Parker Corporation has

Q16: When a note payable is exchanged for

Q29: For the year ended December 31, 2015,

Q33: Didde Co. had 300,000 shares of common

Q56: The deferred tax asset to be recognized

Q59: Companies report trading securities at fair value,

Q85: A mining company declared a liquidating dividend.

Q91: On July 4, 2014, Chen Company issued

Q109: If a long-term note payable has a

Q146: On June 30, 2014, Yang Corporation granted