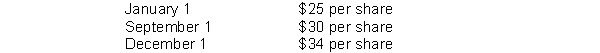

On January 1, 2015, Evans Company granted Tim Telfer, an employee, an option to buy 3,000 shares of Evans Co. stock for $25 per share, the option exercisable for 5 years from date of grant. Using a fair value option pricing model, total compensation expense is determined to be $22,500. Telfer exercised his option on September 1, 2015, and sold his 1,000 shares on December 1, 2015. Quoted market prices of Evans Co. stock during 2015 were  The service period is for three years beginning January 1, 2015. As a result of the option granted to Telfer, using the fair value method, Evans should recognize compensation expense for 2015 on its books in the amount of

The service period is for three years beginning January 1, 2015. As a result of the option granted to Telfer, using the fair value method, Evans should recognize compensation expense for 2015 on its books in the amount of

Definitions:

Optimal Pricing Strategy

A pricing approach aimed at maximizing a company's profits or market share while considering consumer demand and competition.

Marginal Revenue Curve

A graphical representation that shows how the marginal revenue varies as the quantity of output is changed, typically downward sloping for firms facing downward sloping demand curves.

Price Discrimination

A pricing strategy where a seller charges different prices for the same product or service to different customers, not based on costs but on what the seller believes each customer can afford or is willing to pay.

Tying

A marketing strategy where a company requires consumers to buy a secondary product or service together with a primary product.

Q30: Adler Construction Co. uses the percentage-of-completion method.

Q31: At the beginning of 2015, Hamilton Company

Q41: What should be the basic earnings per

Q49: A loss in the current period on

Q77: Under IFRS an affirmative judgment approach is

Q96: On January 1, 2015, Reston Company purchased

Q113: Midland Company follows U.S. GAAP for its

Q120: A company reduces a deferred tax asset

Q155: Companies should record stock issued for services

Q157: Companies should recognize the expense and related