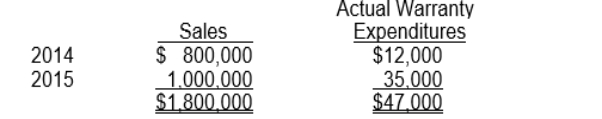

During 2014, Eaton Co. introduced a new product carrying a two-year warranty against defects. The estimated warranty costs related to dollar sales are 2% within 12 months following sale and 3% in the second 12 months following sale. Sales and actual warranty expenditures for the years ended December 31, 2014 and 2015 are as follows:  At December 31, 2015, (assuming the accrual method) Eaton should report an estimated warranty liability of

At December 31, 2015, (assuming the accrual method) Eaton should report an estimated warranty liability of

A) $0.

B) $15,000.

C) $35,000.

D) $43,000.

Definitions:

Food Consumption

refers to the process of ingesting food to provide the body with the necessary nutrients for energy, growth, and maintenance.

Situational Influences

External factors or contexts that affect an individual's behavior, decision-making, or feelings at a given moment.

Environmental Stimuli

External factors or changes in the environment that can evoke a physical or behavioral response in organisms.

Incentives

Rewards or stimuli that motivate individuals to perform actions or exhibit behaviors.

Q6: Putnam Company's 2014 financial statements contain the

Q71: A project financing arrangement refers to:<br>A) an

Q74: The cause for litigation must have occurred

Q76: The ability to consummate the refinancing of

Q77: Which of the following costs should be

Q93: When $5,000,000 in convertible bonds are issued

Q108: A major objective of MACRS for tax

Q116: The right granted to all authors, painters,

Q127: An impairment loss is the amount by

Q137: Hart Corporation owns machinery with a book