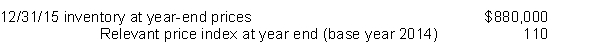

Farr Co. adopted the dollar-value LIFO inventory method on December 31, 2014. Farr's entire inventory constitutes a single pool. On December 31, 2014, the inventory was $640,000 under the dollar-value LIFO method. Inventory data for 2015 are as follows:  Using dollar value LIFO, Farr's inventory at December 31, 2015 is

Using dollar value LIFO, Farr's inventory at December 31, 2015 is

Definitions:

Subsidiary Ledger

A detailed ledger that contains detailed financial information associated with specific accounts, which is summarized in the general ledger.

General Ledger

A comprehensive set of accounts that records all transactions of a company, categorized into assets, liabilities, equity, revenue, and expenses.

Sales Return

Goods returned by the customer to the seller for a refund or credit due to reasons like defects or dissatisfaction.

General Journal

A comprehensive ledger that records all the day-to-day financial transactions of a business.

Q30: The current assets total is<br>A) $6,080,000.<br>B) $5,555,000.<br>C)

Q52: On December 31, 2014, Flint Corporation sold

Q57: If a supplier ships goods f.o.b. destination,

Q76: On June 1, 2014, Yang Corp. loaned

Q81: Huge Cart Inc. gives you the following

Q91: Farr Co. adopted the dollar-value LIFO inventory

Q131: In general, IFRS adheres to very different

Q142: On January 1, 2014, Kline Company decided

Q144: The following accounts were abstracted from Starr

Q149: Which of the following is not considered