Amortization of discount on note.

On December 31, 2014, Green Company finished consultation services and accepted in exchange a promissory note with a face value of $600,000, a due date of December 31, 2017, and a stated rate of 5%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 10%.

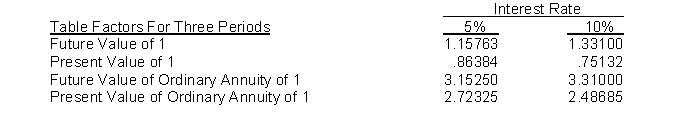

The following interest factors are provided:

Instructions

(a) Determine the present value of the note.

(b) Prepare a Schedule of Note Discount Amortization for Green Company under the effective interest method. (Round to whole dollars.)

(c) Explain how the accounting for a zero-interest-bearing note would differ in

(a) and (b) above.

Definitions:

Bakers

Professionals who prepare and bake breads, pastries, and other baked goods.

Steamed Milk

Milk that has been heated and aerated through the introduction of steam, often used in coffee beverages.

Equilibrium Quantity

The quantity of goods or services supplied that is exactly equal to the quantity demanded at the market equilibrium price.

Equilibrium Price

The price at which the quantity of a good or service demanded equals the quantity supplied, resulting in a balance between production and consumption.

Q2: When the double-extension approach to the dollar-value

Q3: Assume that on January 4, 2015, Johnstone

Q18: Typical contractual situations that are disclosed in

Q39: In order to be classified as an

Q47: IFRS does not intend to issue detailed

Q49: When revenue or expense has been recognized

Q51: Comprehensive income includes all changes in equity

Q116: IFRS requires an impairment loss for a

Q121: GAAP requires reporting inventory at net realizable

Q133: Which table would you use to determine