Use the following to answer questions 26-28:

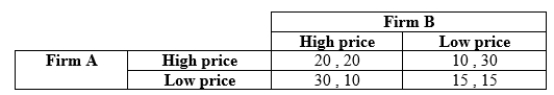

Table 12.16

-(Table 12.16) The payoffs represent profits measured in thousands of dollars. In this infinitely repeated game, Firm A and Firm B are both using grim trigger strategies; they agree to charge a high price in period 1. If Firm A has a change of heart and decides not to charge a high price in period 1, what is Firm A's expected payoff from cheating? Assume that d = 0.9.

Definitions:

Beta

An indicator of how much a stock's price movement varies compared to the general market, signifying its relative risk to the market norm.

Expected Return

A statistical measure of the mean or average return from an investment, considering historical or anticipated performance, often used in financial analysis.

Market Return

The total return of an investment market, comprising both capital gains and dividends or interest, over a given period.

Risk-Free Rate

The theoretical return on an investment with no risk of financial loss, typically represented by the yield on government bonds.

Q7: In the market for used air rifles,

Q14: On a graph, draw an indifference curve

Q18: Ted purchased a comprehensive insurance policy for

Q20: The fact that long-term debt and common

Q42: (Figure 15.8). Suppose the food industry is

Q49: (Table 13.3) Explain why a monopsony faces

Q75: Answer the following questions. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3883/.jpg" alt="Answer

Q77: (Table 15.1) Using the Rawlsian social welfare

Q90: "Stretching" accounts payable is a widely accepted,

Q92: If the firm establishes a block-pricing structure