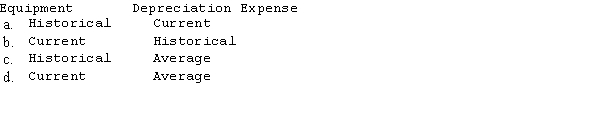

A U.S. parent purchased a foreign subsidiary last year at a price in excess of the subsidiary's book value. The subsidiary's functional currency is the foreign currency. This excess is assumed to be traceable to undervalued equipment. When the parent company prepares its elimination entries for the excess, which of the following combinations of exchange rates should be used?

Definitions:

Q1: Which of the following statements applying to

Q4: Reclassifying net assets from temporarily restricted to

Q18: Supernova Company had the following summarized balance

Q23: Consolidation might not be appropriate even when

Q25: Patents are on the books of a

Q30: A reconciliation of the revenue, profit and

Q38: The characteristic of a partnership where specific

Q39: East Company, a highly diversified corporation, reports

Q44: In a private college, as expenses are

Q72: Goods ordered and originally encumbered at $7,500