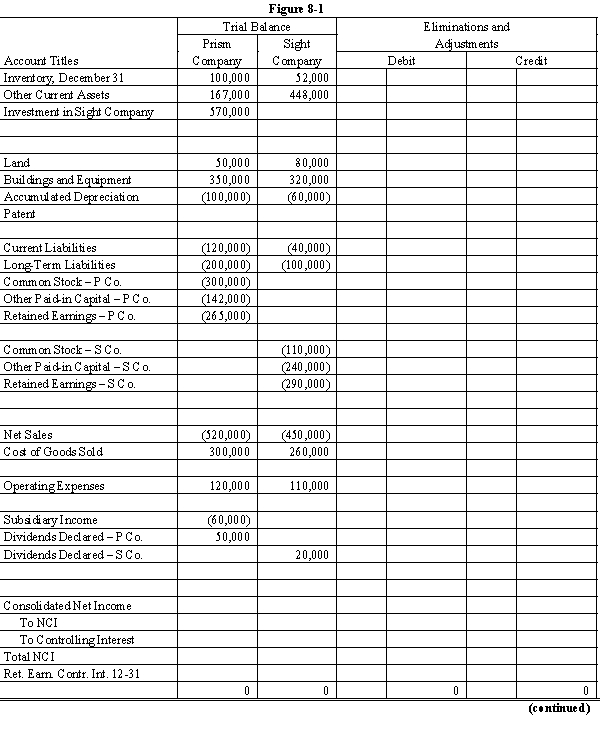

On January 1, 20X1, Prism Company purchased 7,500 shares of the common stock of Sight Company for $495,000. On this date, Sight had 20,000 shares of $10 par common stock authorized, 10,000 shares issued and outstanding. Other paid-in capital and retained earnings were $200,000 and $300,000 respectively. On January 1, 20X1, any excess of cost over book value is due to a patent, to be amortized over 15 years.

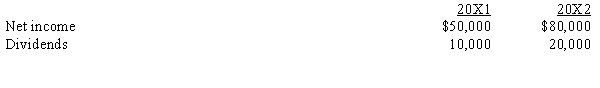

Sight's net income and dividends for two years were:

In November 20X1, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share. The stock dividend was distributed on December 31, 20X1.

For both 20X1 and 20X2, Prism Company has accounted for its investment in Sight Company using the simple equity method.

During 20X1, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 20X1. During 20X2, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 20X2. Sight's gross profit on intercompany sales is 40%.

Required:

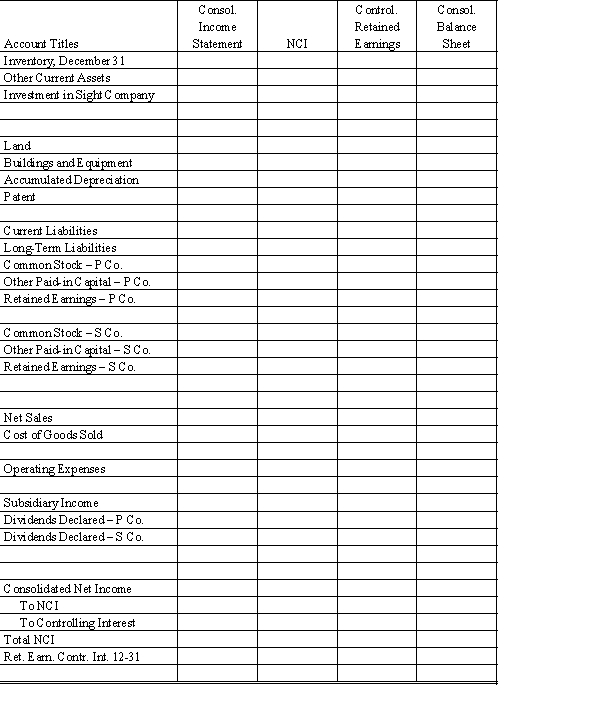

Complete the Figure 8-1 worksheet for consolidated financial statements for 20X2.

Definitions:

Physical Therapist

A healthcare professional specialized in the treatment of individuals to improve mobility and alleviate pain through physical rehabilitation techniques.

Stroke Recovery

The process of regaining lost skills and function after a stroke, which may involve rehabilitation therapy and self-care practices.

Condenser Plates

Components in various devices (such as microscopes or capacitors) that collect and focus light or electrical energy.

Diathermy

A medical and surgical technique that uses high-frequency electric currents to generate heat, primarily for muscle relaxation or tissue removal.

Q6: In an asset acquisition:<br>A)A consolidation must be

Q9: For the Statement of Cash Flows for

Q10: Which of the following statements relating to

Q31: The following selected account balances for the

Q32: The effect of an operating lease on

Q36: Adam Enterprise includes seven industry segments. Operating

Q45: In the space provided, fill in the

Q52: In the Statement of Cash Flows for

Q58: Wolters Corporation is a U.S. corporation that

Q169: An example of a current liability is