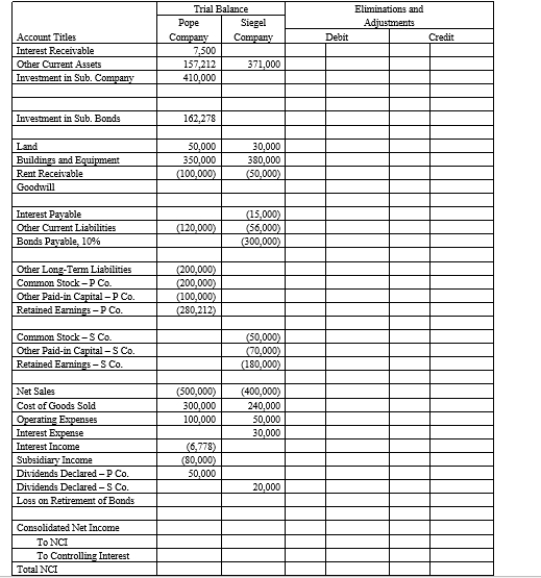

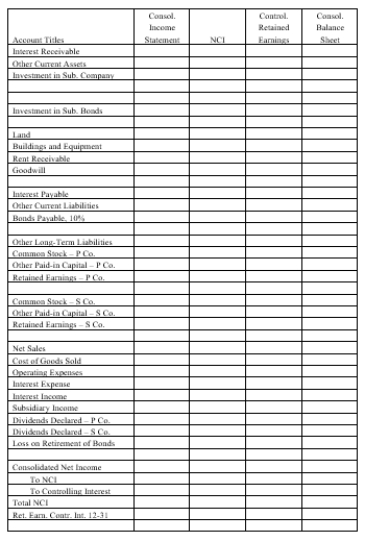

On January 1, 20X3, Pope Company acquired 100% of the common stock of Siegel Company for $300,000. On this date Siegel had total owners' equity of $250,000. Any excess of cost over book value is attributable to goodwill. Pope accounts for its investment in Siegel using the simple equity method.

On July 1, 20X3, Siegel Company sold to outside investors $300,000 par value of 10-year, 10% bonds. The price received was equal to par. The bonds pay interest semi-annually on July 1 and January 1.

During early 20X4, market interest rates on bonds similar to those issued by Siegel decreased to 8%. As a result, the market value of the bonds increased. On July 1, 20X4, Pope purchased $150,000 par value of Siegel's bonds, paying $163,000. Pope still holds the bonds on December 31, 20X4 and has amortized the premium, using the straight-line method.

Required:

Complete the Figure 5-1 worksheet for consolidated financial statements for the year ended December 31, 20X4. Round all computations to the nearest dollar.

Definitions:

Emergency Help

Immediate assistance or support provided during urgent situations to prevent or alleviate suffering.

Triple Somersault

A gymnastic or acrobatic maneuver involving three complete revolutions of the body in the air.

Guinness Book

Refers to the "Guinness World Records," a reference book published annually, listing world records both of human achievements and the extremes of the natural world.

Topic Sentence

The introductory sentence in a paragraph that summarizes the main idea or point.

Q6: Palit buys Quincy's partnership interest in the

Q15: The operating cash flow ratio is computed

Q17: Investor has a 40% ownership interest in

Q20: Partners A and B have a profit

Q37: Page Company purchased an 80% interest in

Q38: Plymouth Company holds a 90% interest in

Q39: A company has cash of $800, current

Q40: Refer to Gainesville Truck Center. What is

Q82: On January 1 of the current year,

Q110: The effective interest method amortizes premium or