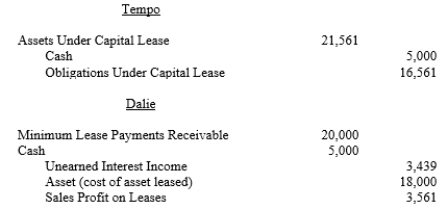

Tempo Industries is an 80%-owned subsidiary of Dalie Inc. On January 1, 20X2, Dalie leased an asset to Tempo and the following journal entries were made:

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year. The implicit interest rate used by both Dalie and Tempo is 8%.

Required:

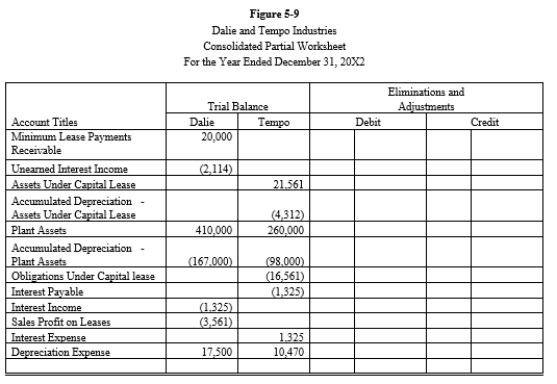

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-9 partial worksheet of December 31, 20X2. Key and explain all eliminations and adjustments.

Definitions:

Employee Handbook

A manual or document that provides information about the company's policies, procedures, and guidelines for employees.

Corporate Social Responsibility

A business model that integrates self-regulation into the business framework, where companies commit to contributing to societal goals and a sustainable environment.

Public Expectations

The beliefs or anticipations that the general public holds regarding the behavior, actions, and standards of individuals, organizations, or governments.

Australian Legal System

The legal framework in Australia, consisting of both statute and common law, that governs legal procedures, rights, and responsibilities.

Q2: For financial accounting purposes, assets of an

Q8: Company P purchased a 30% interest in

Q13: On January 1, 20X1, Parent Company purchased

Q20: Partners A and B have a profit

Q23: Consolidation might not be appropriate even when

Q31: Which of the following statements is true?<br>A)No

Q33: Sharp Company owns a Japanese subsidiary, whose

Q34: On January 1, 20X2, U.S.A. Inc. created

Q100: Refer to Kids R Kids Company.<br>A)The total

Q152: Refer to Kalahari Limited. What is the