On January 1, 20X1, Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent uses the simple equity method to account for its investment in subsidiary.

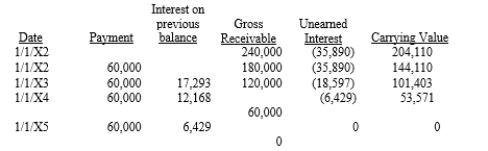

On January 1, 20X2, Parent purchased equipment for $204,110 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies. A lease amortization schedule, applicable to either company, is presented below:

Required:

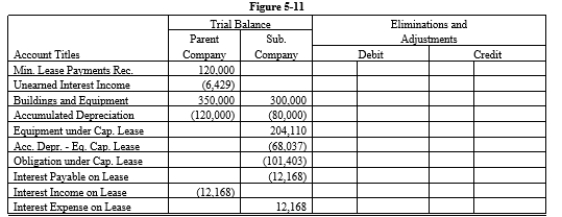

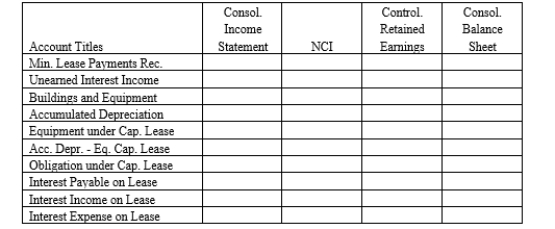

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-11 partial worksheet as of December 31, 20X3. Key and explain all eliminations and adjustments.

Definitions:

Liabilities to Stockholders' Equity

A measure comparing a company’s obligations to the amount invested by its shareholders, often used to assess financial health.

Creditors' Risk

The risk that debtors will fail to make payments on debts owed, affecting creditors' financial positions.

Nonpayment

The failure to fulfill a financial obligation, such as not paying bills, debts, or invoices when they are due.

Fiscal Year

A 12-month period used for accounting purposes and preparing financial statements, which may not necessarily align with the calendar year.

Q2: Phil Company leased a machine to its

Q4: Robbins Corporation has a wholly-owned foreign subsidiary,

Q9: RWB Corporation, a U. S. based company,

Q11: Smart Corporation is a 90%-owned subsidiary of

Q19: In consolidated financial statements, it is expected

Q22: The method of accounting for subsidiaries where

Q24: For companies that meet the requirements of

Q26: When partnership profits are allocated based on

Q35: Dills Company purchased an 80% interest in

Q100: A company has property, plant, and equipment