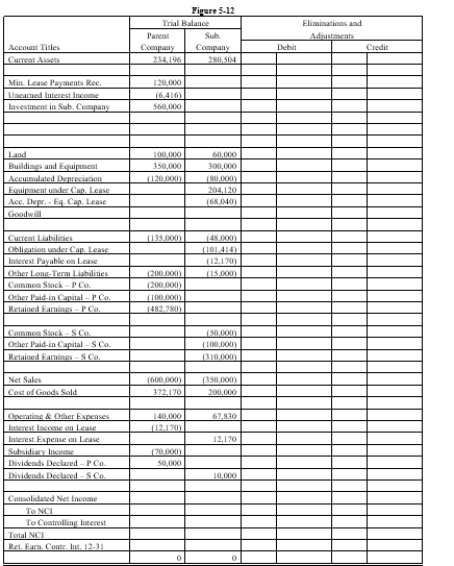

On January 1, 20X1, Parent Company purchased 100% of the common stock of Subsidiary Company for $390,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent accounts for the Investment in Subsidiary using the simple equity method.

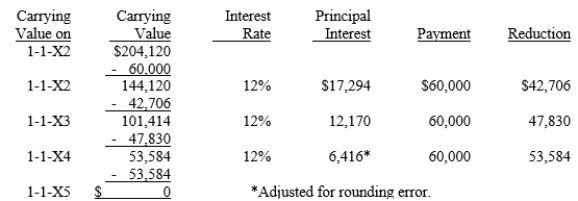

On January 1, 20X2, Parent purchased equipment for $204,120 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies.

A lease amortization schedule, applicable to either company, is presented below:

On January 1, 20X3, Parent held merchandise acquired from Subsidiary for $10,000. During 20X3, subsidiary sold merchandise to Parent for $50,000, of which $15,000 is held by Parent on December 31, 20X3. Subsidiary's usual gross profit on affiliated sales is 40%.

Required:

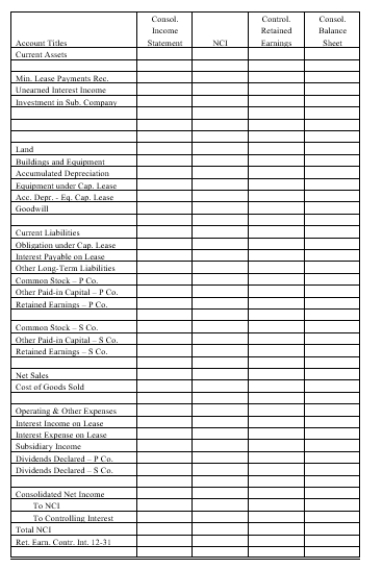

Complete the Figure 5-12 worksheet for consolidated financial statements for the year ended December 31, 20X3. Round all computations to the nearest dollar.

Definitions:

Diaphoretic

Characterized by profuse sweating, often as a symptom of illness or a response to medication.

Hypertensive

Relating to, or suffering from hypertension, which is high blood pressure.

Folic Acid

A B-vitamin essential for cell growth and metabolism, crucial for pregnant women to prevent neural tube defects in the fetus.

Childbearing Age

The period in a person's life, typically ranging from late teens to late 40s, when they are physically capable of conceiving and bearing children.

Q13: What is recorded by the lessee and

Q16: Consolidated financial statements are appropriate even without

Q20: A manufacturing company's weekly payroll is $80,000

Q36: Partner A began the year with $20,000

Q38: Which of the following procedures would be

Q43: Which of the following statements about interim

Q47: When an economic transaction is denominated in

Q55: On January 1, 2019, Kroger Corporation issued

Q69: During May of the current year, Grant

Q85: A long-term lease liability would appear on