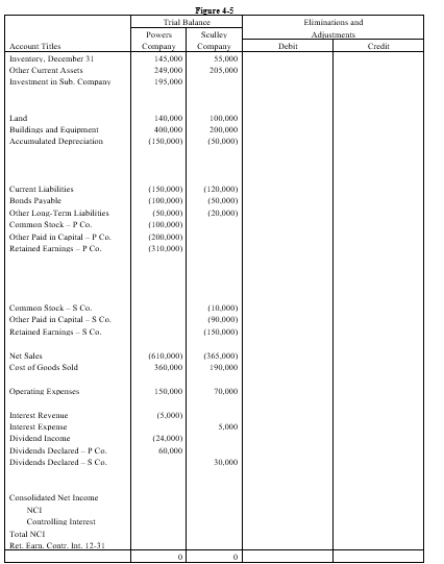

On January 1, 20X1, Powers Company acquired 80% of the common stock of Sculley Company for $195,000. On this date Sculley had total owners' equity of $200,000 (common stock, other paid-in capital, and retained earnings of $10,000, $90,000, and $100,000 respectively).

Any excess of cost over book value is attributable to inventory (worth $6,250 more than cost), to equipment (worth $12,500 more than book value), and to patents. FIFO is used for inventories. The equipment has a remaining life of five years and straight-line depreciation is used. The excess to the patents is to be amortized over 20 years.

On July 1, 20X2 Sculley borrowed $100,000 from Powers with a 10% 1-year note; interest is due at maturity.

On January 1, 20X2, Powers held merchandise acquired from Sculley for $10,000. During 20X2, Sculley sold merchandise to Powers for $50,000, $20,000 of which is still held by Powers on December 31, 20X2. Sculley's usual gross profit on affiliated sales is 50%.

On December 31, 20X1, Powers sold equipment to Sculley at a gain of $10,000. During 20X2, the equipment was used by Sculley. Depreciation is being computed using the straight-line method, a five-year life, and no salvage value.

Both companies have a calendar-year fiscal year.

Assume that during 20X1 and 20X2, Powers has appropriately accounted for its investment in Sculley using the cost method.

Required:

a.Using the information above or on the Figure 4-5 worksheet, prepare a determination and distribution of excess schedule.

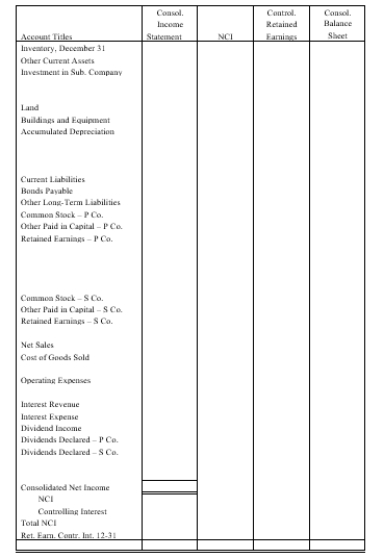

b.Complete the Figure 4-5 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Definitions:

Bystander Effect

In social psychology, this phenomenon describes how individuals become less likely to help a victim when they are in a group.

GRIT

Graduated and Reciprocated Initiatives in Tension-Reduction—a strategy designed to decrease international tensions.

Social Trap

A situation in which the conflicting parties, by each rationally pursuing their self-interest, become caught in mutually destructive behavior.

Mere Exposure Effect

A psychological effect in which people show a preference for items or concepts they recognize simply because they know them.

Q8: The purchase of additional shares directly from

Q10: On January 1, 20X1, Pepper Company purchased

Q26: Two types of intercompany stock purchases significantly

Q37: In performing the impairment test for goodwill,

Q39: Green Corporation, a wholly owned British subsidiary

Q43: If a subsidiary's functional currency is not

Q61: The legal owner of a leased asset.<br>A)Bond<br>B)Contract,

Q76: _ is the liability created when customers

Q93: A twenty-year lease obligation would appear on

Q120: Refer to Gainesville Truck Center. Which of