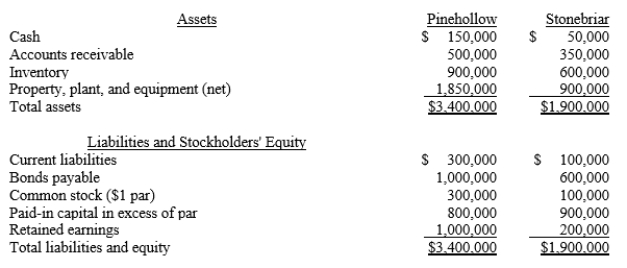

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:  The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of goodwill that will be included in the consolidated balance sheet immediately following the acquisition?

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of goodwill that will be included in the consolidated balance sheet immediately following the acquisition?

Definitions:

Q3: The Blue Reef Company purchased the net

Q4: On January 1, 20X1, Parent Company acquired

Q14: Company P owns 80% of the 10,000

Q28: When a parent sells its subsidiary interest,

Q29: Pete purchased 100% of the common stock

Q36: Adam Enterprise includes seven industry segments. Operating

Q47: Term referring to the date that a

Q48: Which of the following statements regarding bonds

Q57: Refer to King Cotton Company. What are

Q58: FASB standards require which of the following