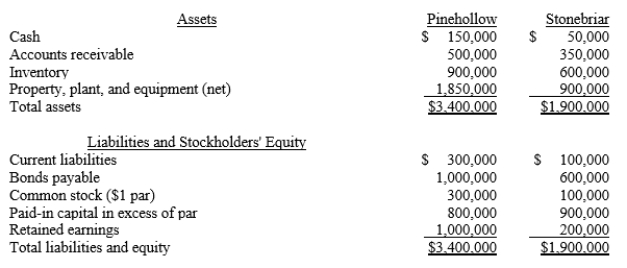

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:  The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of goodwill that will be included in the consolidated balance sheet immediately following the acquisition?

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of goodwill that will be included in the consolidated balance sheet immediately following the acquisition?

Definitions:

Exceptional Needs

Requirements or accommodations for individuals with disabilities or unique learning challenges to ensure their full participation in education.

Cultural Factors

Aspects of a society's culture, including values, beliefs, traditions, and behaviors, that influence individuals' attitudes and actions within that society.

Educational Factors

Elements that influence the quality and effectiveness of learning, including teaching methods, school environment, and student engagement.

Full Inclusion

An educational approach where all students, regardless of disability, are integrated into general education classrooms for all or most of the day.

Q2: Lancaster Inc. expects to have taxable income

Q16: The method of accounting for subsidiaries that

Q31: An investor records its share of its

Q33: Matt and Jeff organized their partnership on

Q37: Futura Corporation reported pretax net income of

Q39: Publics Company acquired the net assets of

Q57: Which of the following correctly addresses how

Q117: This debt, evidenced by a formal agreement

Q117: A company borrowed $50,000 on November 1,

Q121: If new equipment purchased during the year