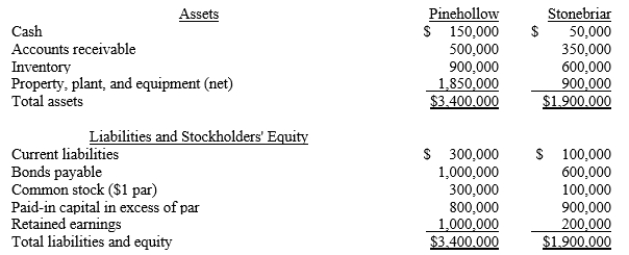

Pinehollow acquired 80% of the outstanding stock of Stonebriar by issuing 80,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:  The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of goodwill that will be included in the consolidated balance sheet immediately following the acquisition?

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of goodwill that will be included in the consolidated balance sheet immediately following the acquisition?

Definitions:

Survey Results

The compiled data and findings obtained from conducting a systematic inquiry or study.

Pizza

A popular dish of Italian origin consisting of a usually round, flattened base of leavened wheat-based dough topped with tomatoes, cheese, and often various other ingredients, baked at a high temperature.

Normal Distribution

A statistical function that represents a bell-shaped curve where most occurrences take place near the mean or average value.

Standard Deviation

A measure in statistics that quantifies the amount of variation or dispersion of a set of values from the mean (average) of the set.

Q2: On January 1, 20X1, Rabb Corp. purchased

Q2: When Palm, Inc. acquired its 100% investment

Q6: Parent has purchased additional shares of subsidiary

Q10: Which of the following statements is not

Q18: Supernova Company had the following summarized balance

Q31: Land is not depreciated because it<br>A)appreciates in

Q43: Which of the following statements about interim

Q65: When a bond is issued at a

Q70: The current ratio is computed by dividing

Q98: Which of the following terms does not