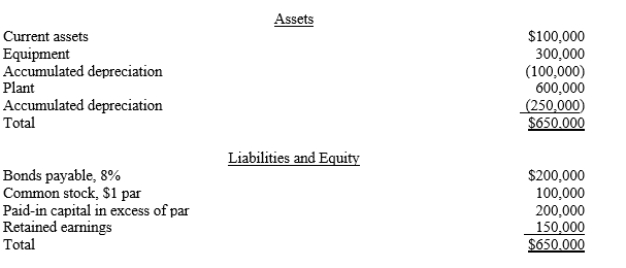

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash. The balance sheet for the Don Company on the date of acquisition showed the following:

Required:

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000. Assume that the Chan Corporation has an effective tax rate of 40%. Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

a.The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.

b.The bonds have a current fair value of $190,000. The transaction is a taxable exchange.

c.There are $100,000 of prior-year losses that can be used to claim a tax refund. The transaction is a taxable exchange.

d.There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due. The transaction is a taxable exchange.

Definitions:

Reward Power

The ability of a person to influence others' actions, behaviors, or attitudes by offering them something desirable.

Salary Raises

Incremental increases in wages given to employees, typically as a reward for performance, tenure, or to adjust for market conditions.

Competence

The ability to perform work tasks successfully.

Potential

The inherent ability or capacity of an individual, object, or concept to develop into something more substantial or perform at a higher level in the future.

Q2: If a business has current assets of

Q2: Assume that Company P purchases a 10%

Q16: Consolidated firms that meet the tax law

Q18: Supernova Company had the following summarized balance

Q18: A United States based company that has

Q30: The effect of recording depreciation for the

Q37: Refer to Fabulous Creations. Which items on

Q62: Assuming that a foreign entity is deemed

Q82: Flossil Fossils Company purchased a tract of

Q87: A type of liability which requires the