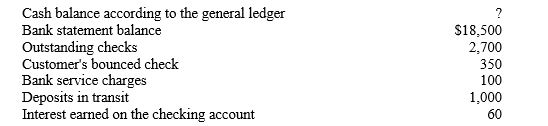

The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31.Cash balance according to the general ledger

-Refer to Dance Town Academy. How will the outstanding checks be handled on a bank reconciliation?

Definitions:

Deferred Tax Item

A financial item on the balance sheet that arises due to timing differences between the recognition of income and expenses for accounting and tax purposes.

Goodwill

An intangible asset that arises when a business is purchased for more than the fair value of its separate net assets.

Recognition

The process of capturing for inclusion in the statement of financial position or statement of profit or loss and other comprehensive income an item that meets the definition of one of the elements of financial statements—an asset, a liability, equity, income, or expenses.

Pre-acquisition Entry

Accounting entries used to adjust the assets and liabilities of companies involved in a merger or acquisition to their fair values at the acquisition date.

Q4: All of the following are external events

Q8: An insurance company received advance payments from

Q13: In order for an internal or external

Q52: Accounts receivable are shown on the balance

Q68: Parlato Corp. has an inventory turnover rate

Q69: The various rules and conventions that have

Q103: The following inventory transactions occurred at Zapata,

Q114: While preparing a bank reconciliation, which of

Q119: Interest earned on the checking account for

Q168: Possible external threats to the organization's success