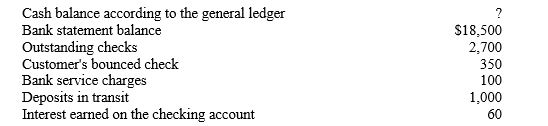

The items listed below were identified while preparing a bank reconciliation for the company's checking account as of March 31.Cash balance according to the general ledger

-Refer to Dance Town Academy. How will the bank services charges be handled on a bank reconciliation?

Definitions:

Net Income

The total earnings of an individual or business after all taxes and other deductions have been subtracted.

Section 1202

A section of the Internal Revenue Code that provides a tax benefit for small business stockholders by excluding part of the gain realized on the sale or exchange of qualified small business stock held for more than five years.

Qualified Small Business Stock

A special designation for shares in certain small businesses that can offer investors tax advantages under specific conditions.

Long Term Capital Gain

Profit earned from the sale of an asset held for more than a year, subjected to preferential tax rates.

Q22: Transportation-in is<br>A)an operating expense.<br>B)part of purchase returns

Q27: Interest is earned but not yet collected<br>A)a

Q44: A company follows the qualitative characteristic of

Q101: Refer to Dance Town Academy. How will

Q113: This method is the easiest to use.<br>A)Straight-line<br>B)Units-of-production<br>C)Double-declining-balance<br>D)MACRS

Q148: Refer to Hesson Properties. What journal entry

Q164: Refer to the information provided for Klump

Q177: The worksheet facilitates preparation of the income

Q211: The difference between a company's net sales

Q217: When the market value of inventory items