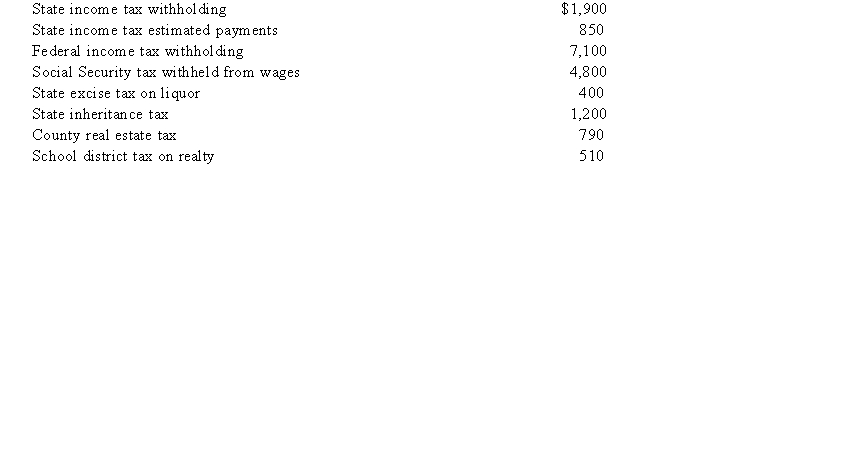

Chuck has AGI of $70,000 and has made the following payments  Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Definitions:

Visionary Organization

An entity that leads with foresight and innovation, anticipating future trends and preparing for changes ahead of its competitors.

Organizational Strategies

Broad-based plans or approaches adopted by a business or organization to achieve its long-term goals and objectives.

Organizational Tactics

Specific actions or strategies that an organization employs to achieve its objectives and navigate its business environment.

Core Values

Fundamental beliefs or principles that guide an organization's internal conduct as well as its relationship with the external world.

Q4: In general, taxpayers are allowed to deduct

Q27: According to the Internal Revenue Code §162,

Q35: You are planning to produce a new

Q41: Long-term capital gains are taxed at the

Q42: How do managers supplement the NPV analysis

Q44: Harold receives a life annuity from his

Q52: Which of the following statements most appropriately

Q85: Which of the following is NOT considered

Q89: Karl works at Moe's grocery. This year

Q119: Assuming the kiddie tax applies, what amount