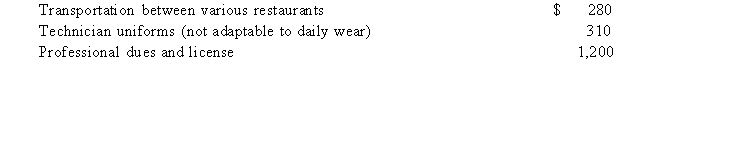

Colby is employed full time as a food technician for a local restaurant chain. This year he has incurred the following expenses associated with his employment:  Colby was reimbursed $125 of the expenses from his employer's accountable plan. What amount can he include with his remaining itemized deductions if his AGI this year is $32,000?

Colby was reimbursed $125 of the expenses from his employer's accountable plan. What amount can he include with his remaining itemized deductions if his AGI this year is $32,000?

Definitions:

Well-Learned

The state of having thoroughly practiced or mastered a skill, knowledge, or task through repetition.

Automatic Skills

Skills that are performed with little conscious thought, often developed through repeated practice and learning.

Two-Track Mind

The concept of the mind simultaneously processing information on two different levels; conscious and unconscious.

Implicit Memory

Memory that influences thoughts and behaviors without conscious awareness, such as skills or habits.

Q2: Miguel, a widower whose wife died in

Q13: Which of the following transactions would not

Q23: Identify the rule dictating that on a

Q38: Assume that Keisha's marginal tax rate is

Q45: The probate estate will include the total

Q52: All of the following are tests for

Q59: After the completion of project analysis, the

Q63: When a taxpayer sells an asset, the

Q72: Business credits are generally refundable credits.

Q92: Jackson earned a salary of $254,000 in