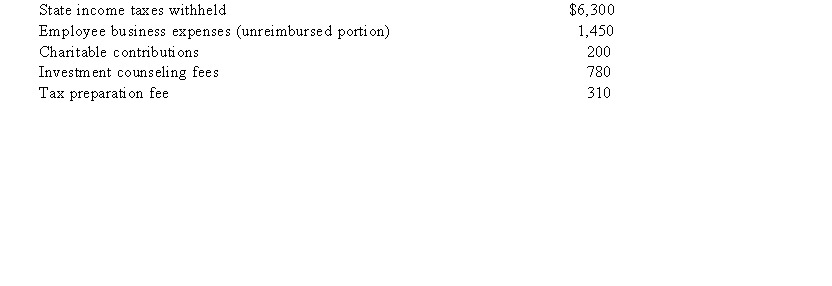

Toshiomi works as a sales representative and travels extensively for his employer's business. This yearToshiomi was paid $75,000 in salary and made the following expenditures:  Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). CalculateToshiomi's taxable income if he files single with one personal exemption.

Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). CalculateToshiomi's taxable income if he files single with one personal exemption.

Definitions:

Interest Earned

The income received from investing in interest-bearing financial instruments or accounts.

Net Income

The total profit or loss of a business after all expenses, taxes, and costs have been subtracted from total revenue.

Interest Expense

The cost incurred by an entity for borrowed funds over a specific period, including loans, bonds, or lines of credit.

Earnings Per Share

A company's net income divided by the number of outstanding shares of its common stock.

Q14: Project analysis, in addition to NPV analysis,

Q20: Life insurance is an asset that can

Q36: Vincent is a writer and U.S. citizen.

Q44: If tax rates are decreasing:<br>A) taxpayers should

Q55: Cory recently sold his qualified small business

Q68: Which of the following statements regarding tax

Q69: Gross income includes:<br>A) all income from whatever

Q74: The phrase "ordinary and necessary" means that

Q94: A trust is a legal entity whose

Q105: Graham has accepted an offer to do