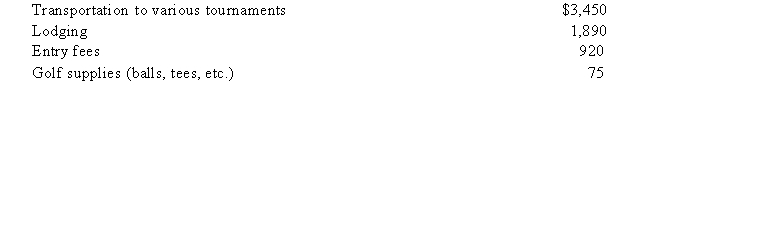

Detmer is a successful doctor who earned $204,800 in fees this year, but he also competes in weekend golf tournaments. Detmer reported the following expenses associated with competing in almost a dozentournaments:  This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

Definitions:

Informed Consent

Principle that individuals being assessed should give their permission for the assessment after they are given information concerning such items as the nature and purposes of the assessment, fees, involvement by others in the assessment process (e.g., teachers, therapists), and the limits of confidentiality.

Justifiable Deception

Situations or contexts in which misleading or lying is considered acceptable or warranted based on overarching ethical or moral standards.

Accreditation Standard

A set of criteria or guidelines used by accrediting bodies to evaluate and recognize the quality and standards of educational institutions or programs.

Assessment

Assessment refers to the systematic process of evaluating an individual's performance, skills, knowledge, or characteristics, using various types of instruments or techniques.

Q16: Sal, a calendar year taxpayer, uses the

Q37: Including adjusted taxable gifts in the taxable

Q57: This year Clark leased a car to

Q59: Which of the following statements regarding realized

Q60: Kathryn is employed by Acme and they

Q77: The principle of realization for tax purposes

Q86: The gross estate always includes the value

Q95: A business generally adopts a fiscal or

Q103: Bonnie and Ernie file a joint return.

Q113: In order for a transfer to be