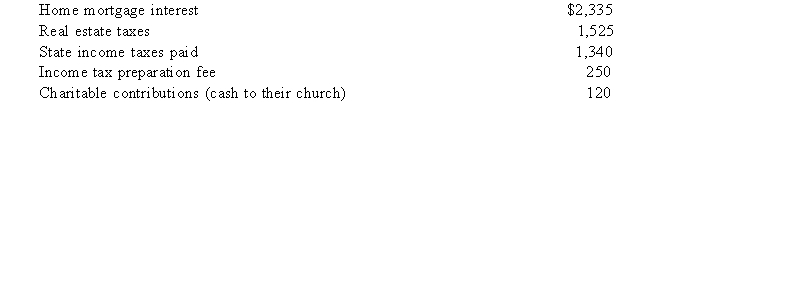

Misti purchased a residence this year. Misti is a single parent and lives with her 1-year old daughter. This year, Misti received a salary of $63,000 and made the following payments:  Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Definitions:

Traits

Characteristic features of an individual's personality that are consistent across different situations.

Humanistic

A psychological perspective emphasizing individual potential, self-actualization, and the unique human experience within a nurturing environment.

Psychoanalytic

Relating to a systematic structure of theories concerning human behavior and the development of the personality, as well as techniques for treating psychological disorders, originally developed by Freud.

Religious Views

Opinions or beliefs concerning the nature, existence, and worship of a deity or deities, and the spiritual life.

Q16: Sal, a calendar year taxpayer, uses the

Q21: Identify which of the items below help

Q24: A project requires an initial investment in

Q33: Sally is a cash basis taxpayer and

Q39: Proceeds of life insurance paid to the

Q49: Jared, a tax novice, has recently learned

Q50: Petroleum Inc. owns a lease to extract

Q65: Simulation models are useful:<br>I. To understand the

Q77: Taxpayers must maintain written contemporaneous records of

Q104: This year Samantha gave each of her