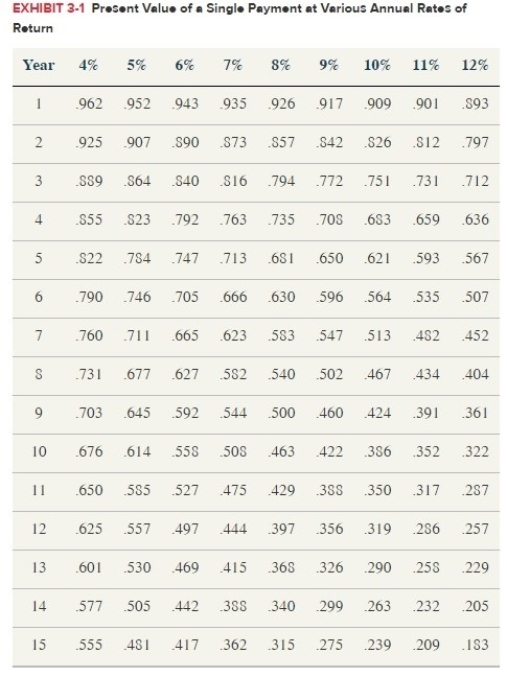

Based only on the information provided for each scenario, determine whether Eddy or Scott will benefit more from using the timing strategy and why there will be a benefit to that person. Use Exhibit 3.1.  a. Eddy has a 40% tax rate. Scott has a 30% tax rate.b. Eddy and Scott each have a 40% tax rate. Eddy has $10,000 of income that could be deferred; Scott has$20,000 of income that could be shifted.c. Eddy and Scott each have a 40% tax rate and $20,000 of income that could be deferred. Eddy's after-tax rate of return is 8%. Scott's after-tax rate of return is 10%.d. Eddy and Scott each have a 40% tax rate, $20,000 of income that could be deferred, and an after-tax rate of return of 10%. Eddy can defer income up to 3 years. Scott can defer income up to 2 years.

a. Eddy has a 40% tax rate. Scott has a 30% tax rate.b. Eddy and Scott each have a 40% tax rate. Eddy has $10,000 of income that could be deferred; Scott has$20,000 of income that could be shifted.c. Eddy and Scott each have a 40% tax rate and $20,000 of income that could be deferred. Eddy's after-tax rate of return is 8%. Scott's after-tax rate of return is 10%.d. Eddy and Scott each have a 40% tax rate, $20,000 of income that could be deferred, and an after-tax rate of return of 10%. Eddy can defer income up to 3 years. Scott can defer income up to 2 years.

Definitions:

CCA Class

In the context of tax regulations, CCA Class (Capital Cost Allowance Class) pertains to categories defined by tax authorities for depreciating tangible property over its useful life for tax purposes.

Net Advantage to Leasing

The benefit that arises from leasing an asset rather than purchasing it, considering factors like tax advantages and cash flow.

Tax Rate

The rate at which a person or business is taxed by the state on their earnings or gains.

CCA Rate

Capital Cost Allowance rate, which is the rate at which a business can claim depreciation on certain property types for tax purposes in Canada.

Q2: The executor of Isabella's estate incurred administration

Q4: The exclusion ratio for a purchased annuity

Q13: This year Larry received the first payment

Q58: Joyce's employer loaned her $50,000 this year

Q62: This fall Marsha and Jeff paid $5,000

Q63: Don's personal auto was damaged in a

Q89: Shea is a 100% owner of Mets

Q98: Earl and Lawanda Jackson have been married

Q99: An investment's time horizon does not affect

Q107: Tax credits are generally more valuable than