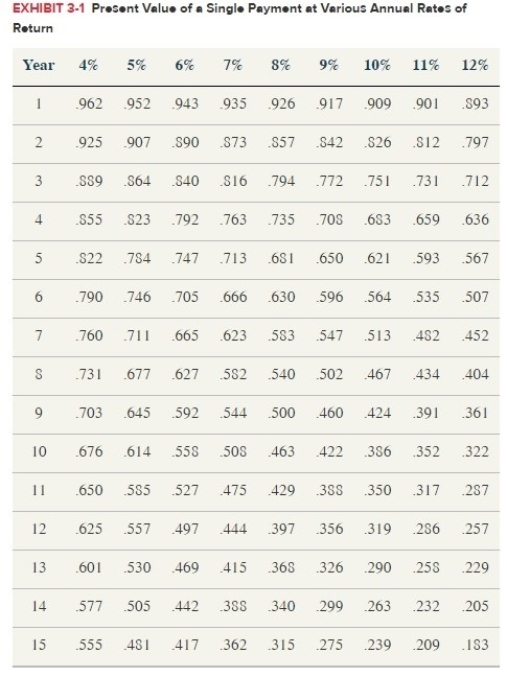

Based only on the information provided for each scenario, determine whether Eddy or Scott will benefit more from using the timing strategy and why there will be a benefit to that person. Use Exhibit 3.1.  a. Eddy has a 40% tax rate. Scott has a 30% tax rate.b. Eddy and Scott each have a 40% tax rate. Eddy has $10,000 of income that could be deferred; Scott has$20,000 of income that could be shifted.c. Eddy and Scott each have a 40% tax rate and $20,000 of income that could be deferred. Eddy's after-tax rate of return is 8%. Scott's after-tax rate of return is 10%.d. Eddy and Scott each have a 40% tax rate, $20,000 of income that could be deferred, and an after-tax rate of return of 10%. Eddy can defer income up to 3 years. Scott can defer income up to 2 years.

a. Eddy has a 40% tax rate. Scott has a 30% tax rate.b. Eddy and Scott each have a 40% tax rate. Eddy has $10,000 of income that could be deferred; Scott has$20,000 of income that could be shifted.c. Eddy and Scott each have a 40% tax rate and $20,000 of income that could be deferred. Eddy's after-tax rate of return is 8%. Scott's after-tax rate of return is 10%.d. Eddy and Scott each have a 40% tax rate, $20,000 of income that could be deferred, and an after-tax rate of return of 10%. Eddy can defer income up to 3 years. Scott can defer income up to 2 years.

Definitions:

Par-Value

The face value of a bond or stock as stated by the issuing company, which might differ from its market value.

Stock Certificate

A document that serves as a stockholder’s proof of ownership in a corporation.

Fixed Face Value

The predetermined and constant value at which a financial instrument, like a bond, is redeemed by the issuer at maturity.

Dangerous Drug

A substance that has been legally recognized as posing a significant risk of harm to those who use it, often due to its potential for abuse or addiction.

Q29: Which of the following is not a

Q40: Which of the following income earned by

Q51: S corporations are required to file Form

Q58: Ethan owned a vacation home at the

Q78: Which statement best describes the U.S. framework

Q88: Giselle is a citizen and resident of

Q99: Claire donated 200 publicly-traded shares of stock

Q105: The gross estate includes the value of

Q116: Commercial domicile is the location where a

Q122: The tax on cumulative taxable gifts is