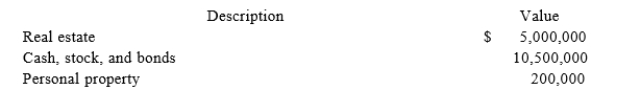

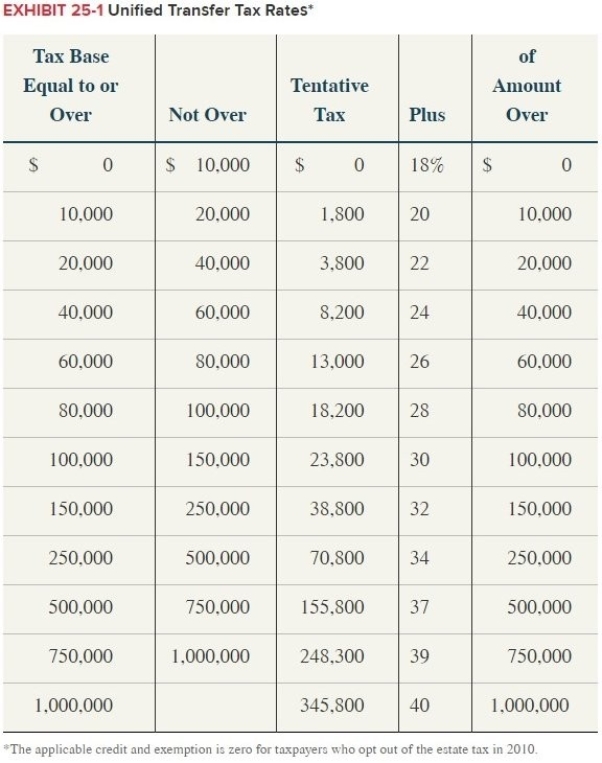

At his death in 2017, Nathan owned the following property:  The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million a which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathanhas never been married. What is the amount of his estate tax due? (Use Exhibit 25-1)

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million a which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathanhas never been married. What is the amount of his estate tax due? (Use Exhibit 25-1)

Definitions:

Journal Entry

A record that represents the business transactions in the accounting books, involving at least one debit and one credit.

Stocks And Bonds

Financial instruments representing ownership in a company (stocks) or a debt agreement (bonds) from an issuer to the holder.

Journal Entry

A record in accounting that reflects a business transaction, listing the accounts and amounts to be debited and credited.

Fair Value

The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Q2: The all-inclusive definition of income means that

Q4: Mighty Manny, Incorporated manufactures ice scrapers and

Q5: Tyson is a 25% partner in the

Q21: Which of the following expenses incurred by

Q33: Unlike partnerships, adjustments that decrease an S

Q47: Tatia's basis in her TRQ partnership interest

Q62: Sheri and Jake Woodhouse have one daughter,

Q68: XYZ, LLC has several individual and corporate

Q79: The applicable credit is designed to:<br>A) exclude

Q99: Claire donated 200 publicly-traded shares of stock