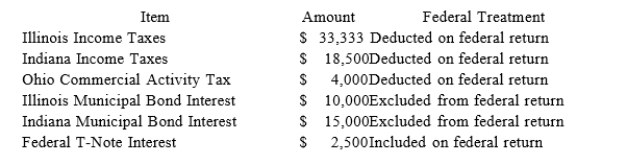

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the80) following items on its federal tax return in the current year:  PWD's Federal Taxable Income was $100,000. Calculate PWD's Illinois state tax base.

PWD's Federal Taxable Income was $100,000. Calculate PWD's Illinois state tax base.

Definitions:

Current Ratio

A liquidity ratio that measures a company's ability to cover its short-term obligations with its current assets.

Gross Margin Percentage

A financial metric that measures the difference between revenue and the cost of goods sold, divided by revenue, expressed as a percentage; it shows the proportion of money available to cover other expenses and profit.

Return On Total Assets

A financial ratio that measures the profitability of a company relative to its total assets, indicating how effectively a company is using its assets to generate earnings.

Long-Term Debt

Borrowings and financial obligations that are due for repayment in a period exceeding one year.

Q29: Which of the following items are subject

Q35: Rob is currently considering investing in municipal

Q44: If an unmarried taxpayer provides more than

Q46: At the beginning of the year, Clampett,

Q66: In order to be a qualifying relative

Q73: Under the entity concept, a partnership interest

Q74: Nadine Fimple is a one-third partner in

Q81: Ypsi Corporation has a precredit U.S. tax

Q86: Holmdel, Inc., a U.S. corporation, received the

Q107: PWD Incorporated is an Illinois corporation. It