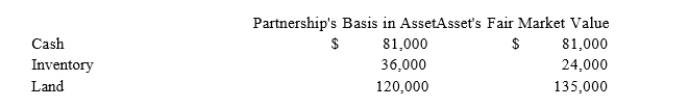

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:  What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Segregated Schools

Educational institutions that were divided based on racial or ethnic lines, a practice particularly prevalent in the United States before the Civil Rights Movement.

Civil Rights Movement

A pivotal social justice movement in the United States during the 1950s and 1960s aimed at ending racial discrimination and segregation.

Sagebrush Rebellion

A political movement in the Western United States advocating for greater local control over federal lands, primarily during the late 20th century.

Gated Communities

Residential areas enclosed by fences or walls, controlled by access gates, designed to provide enhanced security and privacy for their inhabitants.

Q1: Lola is a 35% partner in the

Q6: Daniel's basis in the DAT Partnership is

Q19: Gordon operates the Tennis Pro Shop in

Q27: To be eligible for the "closer connection"

Q36: KBL, Inc., AGW, Inc., Blaster, Inc., Shiny

Q38: Delivery of tangible personal property through common

Q59: If a taxpayer loses a case at

Q60: This year Nicholas earned $500,000 and used

Q88: Entities no longer have to classify deferred

Q99: Ricardo transferred $1,000,000 of cash to State