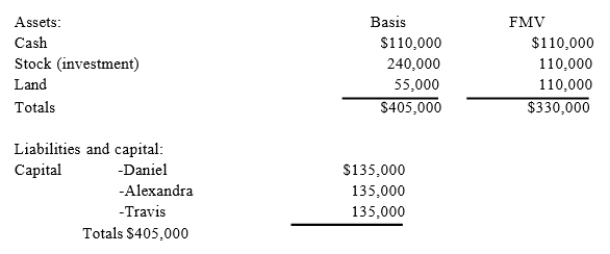

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation o his partnership interest. DAT reports the following balance sheet just before the distribution:  If DAT has a §754 election in place, what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Q1: At his death in 2017, Nathan owned

Q15: Campbell was researching a tax issue and

Q26: Davison Company determined that the book basis

Q46: Hanover Corporation, a U.S. corporation, incurred $300,000

Q62: Marty is a 40% owner of MB

Q65: Katarina transferred her 10 percent interest to

Q73: Zinc, LP was formed on August 1,

Q84: Janet Mothra, a U.S. citizen, is employed

Q96: Russell Starling, an Australian citizen and resident,

Q97: Which of the following individuals is not