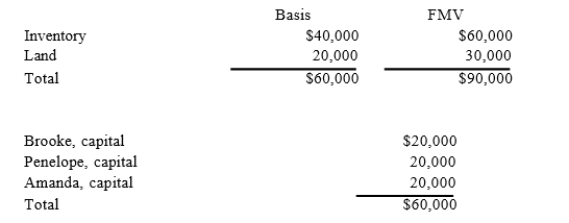

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of$20,000. BPA reports the following balance sheet:  a. Identify the hot assets if Brooke decides to sell her interest in BPA. b. Are these assets "hot" for purposes of distributions?c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issuesshould be considered?

a. Identify the hot assets if Brooke decides to sell her interest in BPA. b. Are these assets "hot" for purposes of distributions?c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issuesshould be considered?

Definitions:

Core Membership

Describes individuals who are considered to be at the essential or central part of a group, organization, or community.

Survival Skills

Skills that enable an individual to sustain life in challenging or dangerous situations, such as in natural environments.

Social Identities

Individuals' conception and perception of themselves derived from their membership in social groups, including nationality, ethnicity, gender, and occupation, among others.

Group Membership

The act of belonging to a group or organization with shared interests, goals, or characteristics.

Q4: Which of the following items is not

Q7: Under which of the following circumstances will

Q29: Jackson is the sole owner of JJJ

Q44: Which of the following statements does not

Q59: Cardinal Corporation reported pretax book income of

Q71: Assume Joe Harry sells his 25% interest

Q72: A client has recently learned of a

Q95: Which of the following statements best describes

Q107: PWD Incorporated is an Illinois corporation. It

Q111: At his death Stanley owned real estate