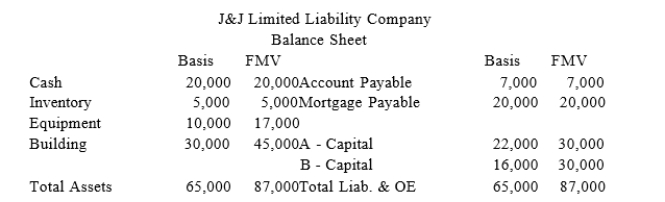

J&J, LLC was in its third year of operations when J&J decided to expand the number of members from two, A & B, with equal profits and capital interests to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a 1/3 capital interestin J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J when C receives her capitalinterest? If, instead, member C receives a 1/3 profit interest, what would be the tax consequences to membersA, B, and C, and to J&J?

Definitions:

Property Rights

Legal rights to use, control, and dispose of land, goods, or intellectual property.

Fishery Management

The practice of regulating fishing activities to ensure sustainable fish populations and ecosystem health over time.

Total Allowable Catch (TAC)

A fishery management tool that sets a cap on the total amount of a particular fish species that can be caught over a specified period.

Sustainable Levels

Levels of production, consumption, and behavior that meet current needs without compromising the ability of future generations to meet their own needs.

Q8: The Emerging Issues Task Force assists the

Q34: Alfred, a one-third profits and capital partner

Q42: It is important to distinguish between temporary

Q65: Katarina transferred her 10 percent interest to

Q67: Proposed and Temporary Regulations have the same

Q79: Over what time period do corporations amortize

Q89: Which of the following statements is true

Q100: Which of the following statements best describes

Q104: Roxy operates a dress shop in Arlington,

Q114: Use tax liability accrues in the state