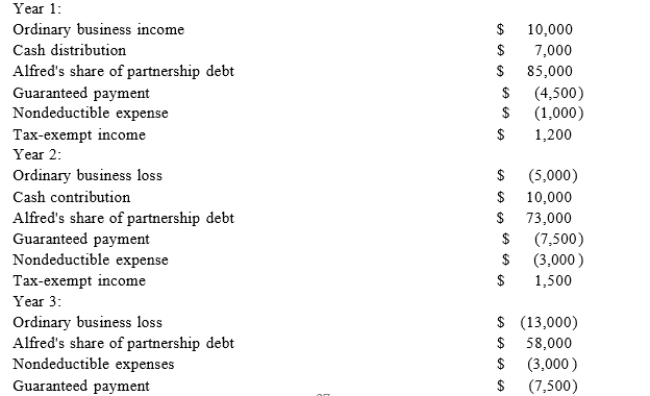

Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfredonly knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

Definitions:

War-Weariness

A condition of feeling fatigue, disillusionment, or a strong desire for peace after prolonged periods of conflict, affecting individuals and societies.

Northerners

Generally refers to the residents or characteristics of the northern part of a country or region, but in U.S. history, it often specifically refers to residents of the Northern States, especially during the Civil War era.

Political Party System

The organized structure and operation of political parties within a political system, including the mechanisms of party formation, competition, and governance.

Presidential Candidates

Individuals who officially run for the office of President in an election, often representing political parties and presenting their platforms to the electorate.

Q20: The "30-day" letter gives the taxpayer the

Q20: Minimum tax credits generated by the corporate

Q28: XYZ Corporation (an S corporation) is owned

Q38: Styling Shoes, LLC filed its 20X8 Form

Q47: Boston, Inc. made a capital contribution of

Q66: Bruin Company received a $100,000 insurance payment

Q68: Boca Corporation, a U.S. corporation, received a

Q79: Roberta transfers property with a tax basis

Q97: The S corporation rules are less complex

Q105: Federal/state adjustments correct for differences between two